March 2022 | SANTA BARBARA REAL ESTATE UPDATE

- Mar 22, 2022

- By Jon-Ryan Schlobohm

- In Uncategorized

- 0 Comments

Amazed! Over and over again, we (real estate agents) are amazed by this current market. As we run into each other, stories are constantly swapped. Our conversations revolve around two themes.

Amazed! Over and over again, we (real estate agents) are amazed by this current market. As we run into each other, stories are constantly swapped. Our conversations revolve around two themes.

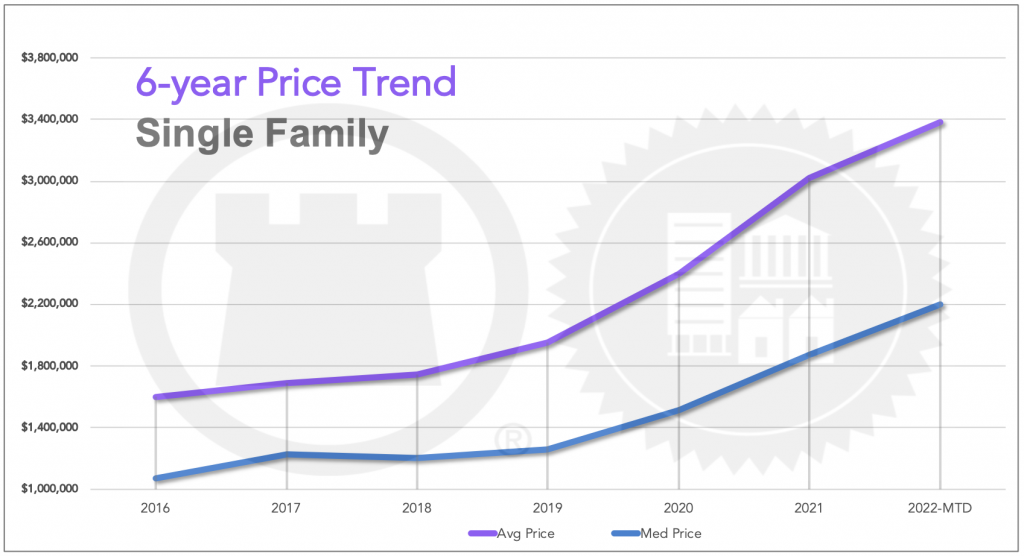

First, is the sheer number of buyers who are competing over our extremely light inventory. Second is the prices that properties are fetching, we continue to be in awe of what properties are selling for.

This is a remarkable example, on March 1, a property was listed on the Upper Westside of Santa Barbara. It is in a nice location with a fun remodeled mid-century style and a larger yard. The home was small at just over 1,000 square feet and only had a carport. It was listed for $1,195,000 and marketed for 1 week until March 7th. The home received 29 offers and sold for $1,775,000 a week after going under contract (March 15). Simply unprecedented.

Maybe a more extreme example of the current market, but so many properties are receiving multiple offers. A quick look at our sales for the first two months of 2022 shows that all properties that go under contract in the first 30 days on average are selling for 7% above the list price.

With all that is occurring in the world and interest rate jumping more than 1% since the beginning of the year, our real estate prices keep pushing up.

The one other trend to note is that our sales volume is dropping off of 2021 all-time high. It appears that we have plenty of buyers, but not as many sellers. Over the last few months, our total available homes and condos for sale between Carpinteria to Goleta have consistently stayed right around 100 properties, well below our norms. We have a short supply of properties for sale.

It continues to be a tremendous time to be a seller!

THE HIGH & LOW

February 2022 Highest Sale | 848 Hotsprings Rd, Montecito | Sold for $20,950,000

February 2022 Lowest Home Sale | 23 Calaveras Ave, Goleta | Sold for $785,000

February Statistics

2022 | Year-To-Date

- Total Sales: 237 in ’22 vs 294 in ’21 | Down 19%

- Total Home Sales: 169 in ’22 vs 225 in ’21 | Down 25%

- Total Condo Sales: 68 in ’22 vs 69 in ’21 | Down 1%

- Median Home Price: $2,200,000 in ’22 vs $1,775,000 in ’21 | Up 24%

- Median Condo Price: $875,000 in ’22 vs $762,000 in ’21 | Up 15%

- Sales Above $5M: 23 in ’22 vs 21 in ’21 | UP 10%

February 2022

- Total Sales: 130 in ’22 vs 137 in ’21 | DOWN 5%

- Pending Sales: 132 in ’22 vs 163 in ’21 | DOWN 19%

- Total Off-Market Sales: 25 Sales | 19%

- Total Cash Sales: 49 Sales | 38%

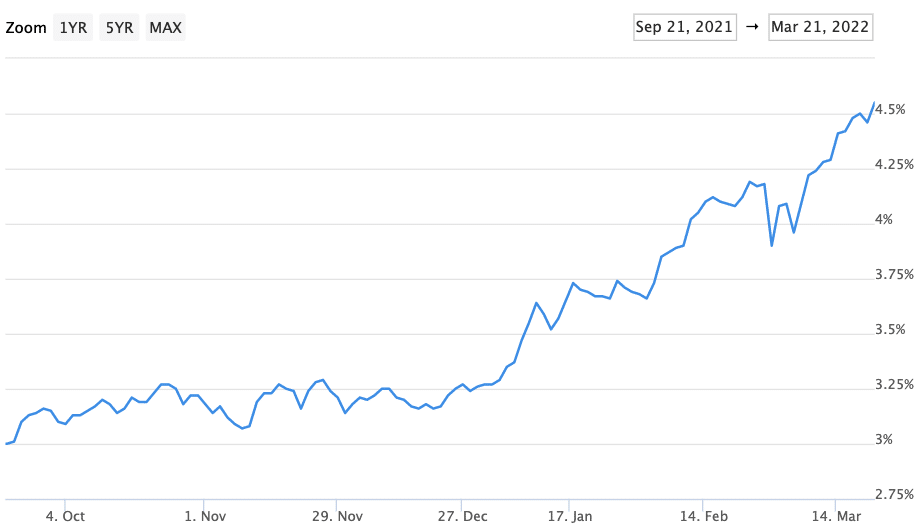

- Average 30-Year Fixed Rate Mortgage: 4.55% as of Mar. 21, ’22

Mortgage Rate Statistics

You may have seen headlines this last week that the Federal Reserve would be increasing their interest rates by .25%. The intuitive response would be to assume mortgage rates will be following suit and increasing by .25%. While this is true for Home Equity Lines of Credit, it is not true for first mortgages (15 and 30 year fixed and ARM loans).

You may have seen headlines this last week that the Federal Reserve would be increasing their interest rates by .25%. The intuitive response would be to assume mortgage rates will be following suit and increasing by .25%. While this is true for Home Equity Lines of Credit, it is not true for first mortgages (15 and 30 year fixed and ARM loans).

These first mortgages have had the Federal Reserve increase baked into the rate for many months now. And, in reality, the current rates are already factoring in more increases by the Federal Reserve by year-end. The current bet is six more increases.

Thus, whenever you see the Federal Reserve headlines of rate adjustments unless they are a surprise to Wall Street, rarely are they, it’s business as usual with mortgage rates.

What you want to be watching is bigger headlines like inflation and job data coming out that would cause a change in stance, and action, by the Fed.

Inflation coming in at 40-year highs with a strong job market would be news that shifts the mortgage market and Wall Street’s bets. It did so over the last month. Should this trend continue into the summer, the markets will likely push 30-year mortgage rates to the high 4% or even low 5% by year-end. The markets would be expecting even more action by the Fed going into 2023.

As a frame of reference, if rates go up by .5% on a $1,000,000 loan, your buying power decreases by $60,000. Inversely, it goes up by $60,000 if rates drop by .5%.

Jeff.Bochsler@Rate.Com

Guaranteed Rate